Why a Disciplined Approach to Investing Is Essential?

Amidst recent market volatility, it's tempting to make emotional investment decisions, but it is good to remember that a disciplined approach is essential to investing.

No matter what type of crisis creates a sharp downturn in the market, trying to time stock and bond trades rarely results in a better outcome for investors.

Here's Why:

In timing the market to avoid the “bad” days, you risk missing the “good” days, too. Not only that, when you time the market, you have backed yourself into a corner where you must make a series of future decisions. “I just sold; when do I buy back in? Once in, when to I sell again?”

In the short term, you may get lucky. And if you get lucky, you can advertise how prescient you were in predicting the last meltdown and perhaps find 10,000 people who will buy your newsletter for $500 a year until they realize you weren't better than anyone else in predicting the market.

Staying the Course

Frankly, history shows that a disciplined long-term investment approach, regardless of what type of economic or political calamity occurs, is what creates steady gains over time.

The keys to investment success are:

- matching your goals to time horizons and risk tolerance,

- implementing a correspondingly appropriate asset allocation,

- monitoring the holdings to make sure they remain appropriate,

- tracking the portfolio so it remains within the proper risk category, and

- making sure you have adequate liquid and safe holdings to ride out prolonged downturns

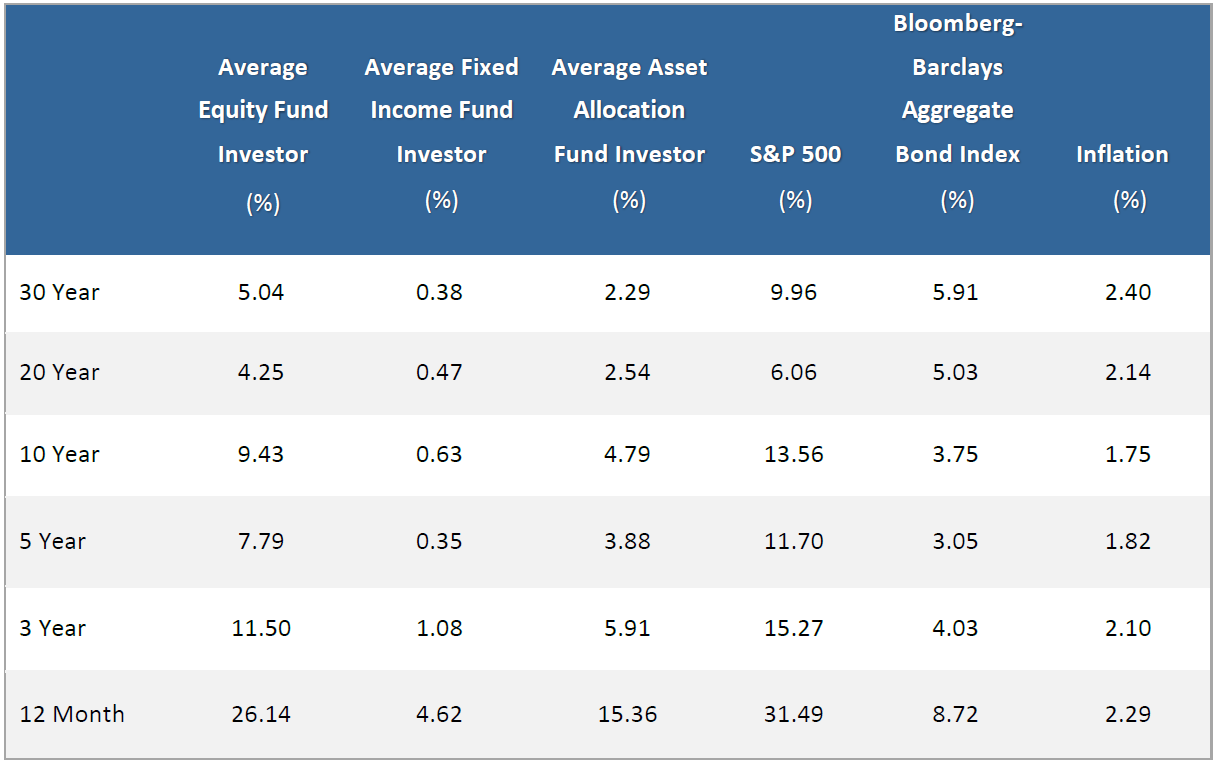

When market volatility makes you start to think about straying from your plan and letting your emotions guide your decisions, it would be good to keep in mind this chart:

Source: “Quantitative Analysis of Investor Behavior, 2020,” DALBAR, Inc. www.dalbar.com

The recent release of this publication could not have been timelier. We can review this report to help gauge how we handle this market and the potential ramifications of our choices into historical context.

Some interesting takeaways from the report:

- “Since 1994, Dalbar's Quantitative Analysis of Investor Behavior (QAIB) has measured the effects of investor decisions to buy, sell and switch into and out of mutual funds over short and long-term time frames.”

- “The results consistently show that the average investor earns less - in many cases, much less - than mutual fund performance reports would suggest.”

- “The analysis covers the 30-year period to December 31, 2019, which encompasses the aftermath of the crash of 1987, the bull market of the 90's, the drop at the turn of the millennium, the crash of 2008, plus recovery periods leading up to the most recent bull market.”

Warren Buffett, probably the most famous equity investor alive, shared this perspective a number of years back:

"In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497."

If you have a long-term perspective, you enjoy the freedom to not have your emotions affect your investment plan.

Working with a financial advisor can help you make good decisions about structuring an investment program suited to meeting your goals while minimizing the likelihood of letting your emotions get the best of you.

About the Author

Rich Preuss, CLU®, ChFC®, Financial Advisor/Owner

Rich views his work as connecting his clients' money to their values. He believes that money management isn't just about rates of return, asset allocation, and maximizing wealth; it is about creating a better life for those you love and creating a better world. Efficient use of your money and resources positions you to accomplish this.

When Rich has spare time, he enjoys spending it with family, reading, cycling, coaching soccer, and hiking the Appalachian Trail (600 miles down, 1500 to go). He's also enjoying working with his fellow owners at Healy Group to develop a better sense of humor.

Equity benchmark performance and systematic equity investing examples are represented by the Standard & Poor's 500 Composite Index, an unmanaged index of 500 common stocks generally considered representative of the U.S. stock market. Indexes do not take into account the fees and expenses associated with investing, and individuals cannot invest directly in any index. Past performance cannot guarantee future results.

Bond benchmark performance are represented by the Bloomberg Barclays Aggregate Bond Index, an unmanaged index of bonds generally considered representative of the bond market. Indexes do not take into account the fees and expenses associated with investing, and individuals cannot invest directly in any index. Past performance cannot guarantee future results.

Average stock investor, average bond investor and average asset allocation investor performance results are based on a DALBAR study, “Quantitative Analysis of Investor Behavior (QAIB), 2020.” DALBAR is an independent financial research firm. Using monthly fund data supplied by the Investment Company Institute, QAIB calculates investor returns as the change in assets after excluding sales, redemptions and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses and any other costs. After calculating investor returns in dollar terms, two percentages are calculated for the period examined: Total investor return rate and annualized investor return rate. Total return rate is determined by calculating the investor return dollars as a percentage of the net of the sales, redemptions, and exchanges for the period.

Dalbar graph is compliments of the Investment Resource Group at Securian Financial Services, Inc.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or stocks in particular, nor should it be construed as a recommendation to purchase or sell a security. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.